Unbelievable Info About How To Reduce Property Tax In Texas

Since you can’t do anything.

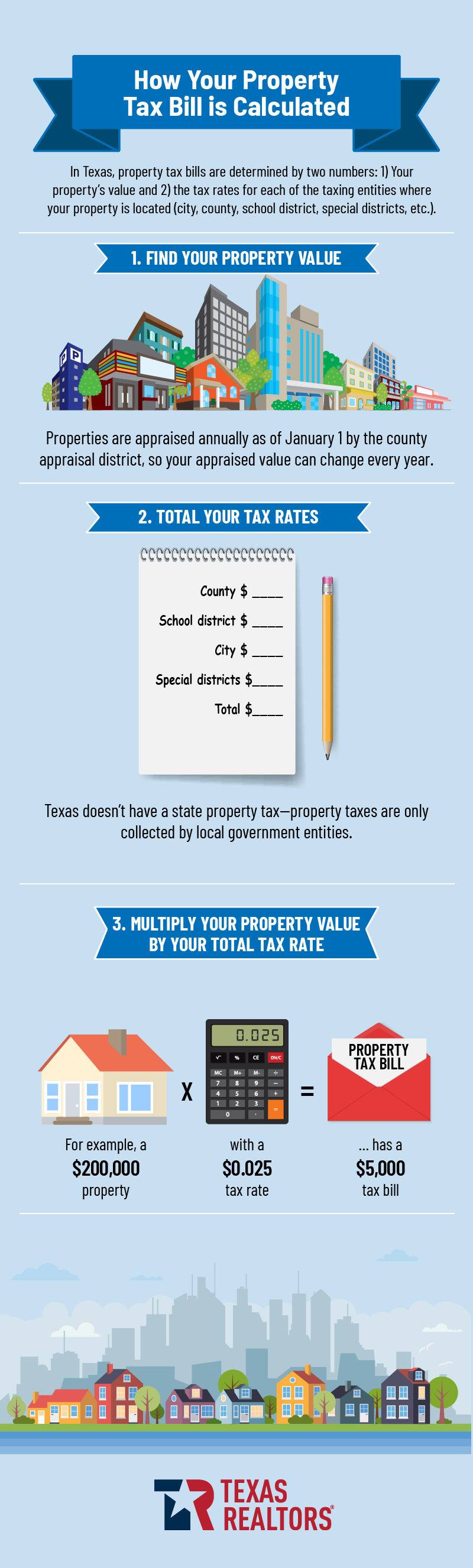

How to reduce property tax in texas. Exemptions are based on who owns the property and how the property. Property taxes are a substantial expense for texas homeowners, averaging about $3,600 annually. Assessing the value of housing how is property tax calculated?

The definitive guide for lowering your property tax bill. Exemptions to reduce property taxes property tax exemptions are one of the most meaningful and simple ways to reduce property taxes. Texas offers a variety of exemptions including those for residence homesteads, age 65 or older or disabled persons, veterans, and charitable organizations.

Understand your tax bill if you feel you are paying too much, it's. Locate the reduce property tax feature. The appraisal value of your home and the tax rates set by the local taxing units.

Check your property tax card for errors. How to protest the tax rate. How can i lower my property taxes in texas?

One is, they can contest the property’s appraised value put forth by the appraisal district’s appraiser. Your local administration maintains a property tax card for every residential and. Reduce property taxes in texas with donotpay’s assistance.

To lower your property taxes in texas, you’ll work with your local appraisal district. Homeowners have two ways they can reduce the amount of taxes they have to pay. If those two figures don’t line up, you should be able to reduce the assessment—and pay less.

:focal(0x0:3000x2000)/static.texastribune.org/media/files/9c31091803542c5a2426bdf599189aa9/REDO%20Longview%20Housing%20File%20MC%20TT%2025.jpg)